2024 Market Pulse: Mid-Year Analysis

We entered 2024 with uncertainty about interest rates, global conflict, and the upcoming election. Last year’s themes were low inventory levels and a top-weighted market heavily driven by high dollar transactions. Midway through this year, the uncertainties remain, and our expectations for price resistance and the outperformance of superior properties have played out.

At the end of last year we described a bifurcated market, with the activity on high quality, premium amenity properties significantly outpacing the rest of the market. This tale of two markets was largely interest rate driven, with the wealthiest land investors less affected by borrowing costs and the alternative for holding cash at higher interest rates.

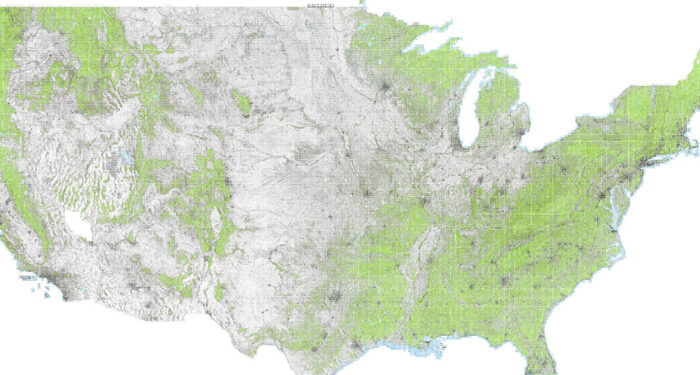

So far in 2024, this market gap has continued to widen. At the upper price ranges, inventory remains low with buyers outnumbering sellers. Quality offerings in desirable areas continue to attract buyers and sell quickly if priced at a supportable level. The scarcity concept is expected to continue as the wealthiest landowners assemble larger holdings which often remain intact for generations or in perpetuity through conservation easements.

Inventories have gradually increased in the lower to mid-price ranges. Supply is outpacing demand and days on the market have increased. Sticky prices at peak market levels combined with buyer apathy has resulted in idle sales activity. As always, the best-in-class properties represent exceptions to the general trends.

Higher sales volume and price appreciation in what traditionally have been considered secondary markets continues, in part because of supply scarcity in primary markets. We also are seeing secondary market appreciation because of an expanded pool of rural land buyers with heightened interest in farm and ranch conservation and rehabilitation through regenerative agricultural techniques.

Auctions continue to grow in demand outside of the traditional, midwestern auction marketplace. As confidence in the auction process grows, more sellers are taking advantage of the ability to dictate timing and terms.

We feel fortunate to represent the finest properties providing enjoyment, stability, and investment value to our clients. Our outlook for the remainder of 2024 is positive. The S&P 500 reaching all-time highs bodes well for the land market, as our sales correlate with the S&P over the long term. Equity volatility and economic or political uncertainty often boosts real estate investment in the near term. Both of those scenarios exist currently.

B Elfland

Managing Director