At the most basic level, a conservation easement is a very specific deed restriction. The drawback of a deed restriction is that it can be undone by a future landowner. A conservation easement is a legal agreement between a property owner and a qualified conservation organization, such as a non-profit land trust, municipality, or governmental entity, which cannot be undone. When entering into this kind of legal agreement, the owner voluntarily agrees to restrict the type and amount of development that may take place on their property. This is possible since the development rights of property are similar to other property rights such as minerals or grazing, which can be leased, sold, gifted, or separated from land. A conservation easement is the legal instrument to separate development rights and have them held in trust for permanent protection.

The Nuts and Bolts of Conservation Easements

What does enacting a conservation easement look like from the landowner perspective? Every conservation easement is customized to the landowner and the property. The traditional land uses including agriculture, hunting, and recreation are always allowed, unless the landowner has specific prohibitions they would like to enact. The landowner decides what limitations or provisions to protect on their property. For instance, if a landowner has an existing house on a property, but has two children, they might reserve the right to build two additional houses. Similarly, if the desire is to have no more construction on the property, a prohibition on future building can be added. Because the easement is permanent, it is imperative to spend time thinking about all the potential uses of the land, and it is a good idea to acquire counsel to help navigate the process.

There are a few misnomers surrounding conservation easements. One is that the landowner loses control of the land, and the public has access. That is absolutely false. There is no public access granted. However, the holder of the conservation easement is required to make a site visit once a year to ensure the terms of the conservation easement are being upheld. This is a coordinated visit with the landowner’s permission. Likewise, a conservation easement is not foolproof protection against condemnation. They can be helpful but may not be able to prevent it.

So why would a landowner voluntarily limit what they can do on their land? First is a desire to keep land the way it is now for future generations. Whether I’m working with a landowner whose history goes back 100 years on land or a new landowner, they all love their land. That love extends beyond their lifetime, and something they want to ensure future generations will enjoy. A conservation easement is an insurance policy to do just that.

Second, there are financial benefits. I will assume that to all the readers of this magazine, it is obvious how valuable land is. Land values have seen an almost 300 percent increase in the past two decades, and the previous year has seen an even more dramatic increase in values. When a landowner places a conservation easement on their property, they are giving up certain development rights, and those rights have value. That value can be used as a tax deduction because land trusts are 501(c)3 non-profits, and the conservation easement is considered a charitable donation. An appraiser is required to determine the value of the contribution. Additionally, a conservation easement lowers the value of a property, which can be a beneficial estate planning tool related to lowering an overall estate value.

How does the permanent, enhanced tax incentive work?

If a conservation easement is voluntarily donated to a land trust or government agency, and if it benefits the public by permanently protecting important conservation resources, it can qualify as a charitable tax deduction on the donor’s federal income tax return.

First enacted temporarily in 2006, the tax incentive was made permanent in 2015 and increases the benefits to landowners by:

- Raising the deduction a donor can take for donating a conservation easement to 50%, from 30%, of his or her annual income;

- Extending the carry-forward period for a donor to take a tax deduction for a conservation agreement to 15 years from 5 years; and

- Allowing qualifying farmers and ranchers to deduct up to 100% of their income, increased from 50%.

Easements vary greatly in value. In general, the highest easement values are found on tracts of open space under high development pressure. In some jurisdictions, placing an easement on one’s land may also result in property tax savings for the landowner.

What is an example of the financial benefit that the permanent tax incentive provides a landowner?

Prior to 2015, a landowner earning $50,000 a year who donated a $1 million conservation easement could take a $15,000 deduction (30% of his or her income) for the year of the donation and for an additional five years, generating a total of $90,000 in tax deductions.

The new, permanent incentive allows that landowner to deduct $25,000 (50% of income) for the year of the donation and for each of an additional 15 years.

This would result in a total of $400,000 in deductions. If the landowner is a farmer or rancher, he or she can deduct $50,000 (100% of income) in the first year and then for each of the following 15 years, realizing a maximum of $800,000 in deductions.

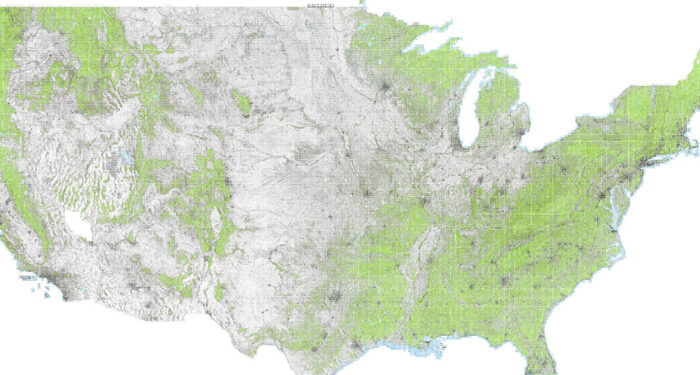

State Income Tax Credits for Conservation

In addition to the federal tax deduction, 14 states offer some form of tax credit for conservation easement donations. Many state incentives apply to fee-simple donations of land as well as conservation easements.

The most powerful state tax incentives for conservation are the transferable tax credits available in Colorado, Georgia, New Mexico, South Carolina and Virginia. In these states, if a landowner donates an easement but doesn’t owe enough tax to use the full credit, they can sell the remaining credit to another taxpayer, generating immediate income.

Eight states and Puerto Rico offer some form of non-transferable income tax credit — Arkansas, Connecticut, Delaware, Iowa, Maryland, Massachusetts, Mississippi and New York. The New York tax credit is unique, offered not at the time of donation, but every year in an amount equivalent to 25% of the property taxes paid on land under easement.