The underlying theme you must recognize in making a land purchase is: Land has become recognized as an investment-class asset.

While you might have many personal objectives when buying land, it is important to consider the investment qualities first before layering in personal objectives. Because, at the end of the day, your major return from this investment is most likely, and most predictably, to come from the appreciation of the asset as opposed to profits from any business operated on the property. You must be cold-blooded in this regard and do not allow yourself to be unduly influenced by qualities that are unlikely to be of broad interest to other buyers.

The easiest way to think about the investment qualities of a piece of land is to consider how easy it would be to resell the land at some point in the future. What are its enduring qualities that are going to make it easy to sell down the road – even though you might currently have no interest in reselling the land? Just like any business venture, the most important element is the exit plan.

Location

Location is the most obvious quality of any piece of real estate. As they say, the three most important qualities of real estate are: location, location, location. Location covers a broad spectrum but, if one is familiar with any given area, it is pretty easy to figure out where everyone wants to be. It could mean easy access to towns and schools or proximity to airports or protected lands. In the case of farms, it might mean easy access to markets.

The biggest detriment of land as an investment-class asset is: It is relatively illiquid. In my experience, it is difficult to overpay for a great location, and it is equally difficult to negotiate a big enough discount for a poor location. In good times, you can sell almost anything, but in bad times you can’t even give away a poorly located piece of real estate. Whereas, while there might be a discount involved, you can always sell a well-located, high-quality property.

When dealing with farms and ranches as an investment-class asset as opposed to, say, a “business opportunity,” access is another important quality that is often ignored. I would like to have a dollar for every time I have heard the comment, “Oh, we have been crossing the neighbor (or that piece of state land) for years to get there; there is no problem with access.” You can ignore the issue by using the excuse that you are just in the farming or ranching business, so you do not care. However, when you need to sell the land or even get a mortgage on it, and you get a title policy that excepts access, today’s investor in land or a lender will consider that to be a significant problem – if not a deal-killer.

Land improvements

Another important part of a real estate purchase is the physical improvements on the land – houses, barns, shops, grain storage, etc. Again, you need to remember: You are thinking about resale when considering the value of a parcel of land. You need to remember that no one needs to own a farm or ranch. If you arrive in Dallas with a family and a job, you need to own a home, so you are going to have to choose from what is available.

It is very rare for a buyer of land to have that kind of motivation. A land buyer can be picky. Consequently, it is unlikely he or she will be willing to pay for improvements he or she does not need or does not like. With that in mind, it is best to buy only the basic improvements that are appropriate for the property and for which someone else would likely be willing to pay.

For example, most buyers are not interested in paying for an extravagant home – particularly if it has an unusual floor plan, enormous square footage or a non-typical architectural style. Expensive single-purpose structures such as an indoor riding arena, an indoor swimming pool, extensive equine facilities, a sales pavilion or a commercial feedlot are examples of structures and facilities that are expensive to build and unlikely to be of interest to the next owner.

Alternatively, if that great piece of land has some “inappropriate improvements,” try to discount them by at least 50% or more – even if it is an improvement you personally can use. After all, when you resell, you are not likely to receive full value for it. It is also important to remember that improvements tend to depreciate while land tends to appreciate.

While price appears to be an important part of a real estate transaction, one can get unduly focused on it. Price is not everything. There are many aspects of a real estate transaction that are important and even critical but do not relate to price. Often, many of these aspects have significant meaning and value to you as a buyer but might well have virtually no value to the seller. Possession (immediate or delayed), the ability to buy quality livestock that are “located,” which crops go with the deal, repairs, seller financing, delaying payments for a period, seller leaseback, and the list goes on beyond the scope of this article.

Every deal is unique in its ability to offer the ability to improve your position outside of negotiating a lower price. This is where an experienced real estate professional can be of great help. Put very simply, anyone who thinks a real estate deal is all about price is missing about 80% of the deal.

Supply and demand

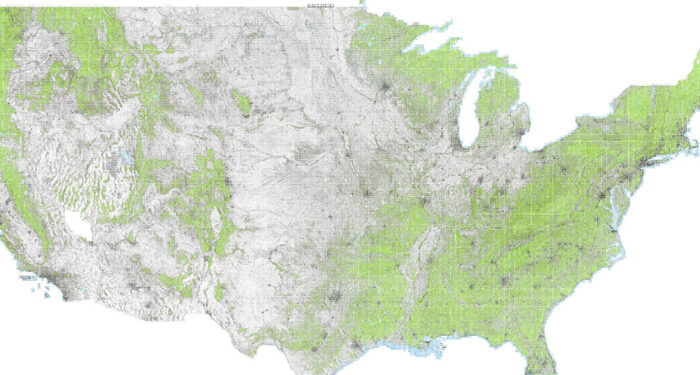

So at the end of the day, what makes a piece of land “investment quality”? It’s all about scarcity and the basic law of supply and demand. To use a simple example: If you own the 100-acre piece of land on the beach, it is one of a kind. There are thousands of acres of land that adjoin it, but you have that one unique parcel (limited supply) and everyone wants to own it (great demand).

We all know what makes a great farm (good soils, water, location) or a great ranch (well-balanced, consistent natural precipitation, good water, well blocked up, strong native grasses) or an outstanding recreational property (scenery, location, trout stream, wildlife, privacy). Obviously, the best are rarely available for good reason: limited supply. There aren’t very many of them, and owners rarely sell them. At whatever level you are buying, you should always think first about buying an investment-class asset that has the highest probability of appreciating and being desirable to other buyers in the future. You can then add some of your own personal needs and desires as appropriate.

Contact the author for more information

James H. Taylor, Director and Real Estate Partner

Billings, MT | taylor@hallandhall.com | (406) 656-7500